As big-name retailers crowd the bathrooms market, how can the indies fight back?

Though I get to work with plenty of bathroom retailers through my Home Interiors Directory website, it isn’t a sector of the retail industry I’ve really blogged about here before – partly because it’s so fragmented, and you have to look pretty hard to find any big-name bathroom specialists, particularly in the world of physical retail.

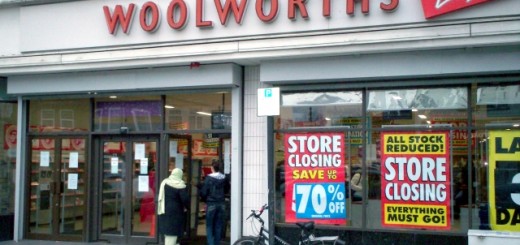

The high-end chain Bathstore is the one high-street name that most people would think of, though it has been having its own difficulties lately. In May, it was sold by previous owner Wolseley to the “turnaround group” Endless. Retail Week’s description of Endless as a “corporate investor in stricken companies” barely conjures up a positive image of Bathstore’s situation or prospects, though Endless seems to have done a good job with the discount bookseller The Works, rescuing it from administration in May 2008 and subsequently restoring both store numbers and profitability.

Though its premium positioning is at the opposite end to The Works’ bargain offer, Endless’s task at Bathstore will be similar: the chain’s store count – currently comprising 126 owned and 42 franchised stores – is down from its 2008 peak, and a new chief executive, Gary Favell, was appointed at the end of last month, tasked with stemming Bathstore’s declining sales and profits. If he can get the right product in the right locations, there’s no reason why Bathstore shouldn’t be able to capitalise on its strong brand and pre-eminent position on the high street.

While the prevailing economic climate has obviously created a challenging environment for big-ticket furniture and home retailers, the bathrooms sector is an especially interesting and competitive one. Bathstore and the big DIY sheds (B&Q, Homebase, Wickes) aside, physical bathroom retail is dominated by independents, while the Internet, in particular, is a significant battleground.

Notably, independent online specialists of the kind that Rob Watson talked about in his 2010 guest blog face a growing challenge from big-name retailers entering the bathrooms space for the first time. The Tesco Finest Bathrooms and Next Bathrooms websites, for example, demonstrate how well-known chains are seeking to enter new categories and appeal to customers via their familiar and trusted brands, particularly in sectors like bathrooms that have traditionally not been brand-driven.

All this raises the question of what independent bathroom retailers – whether offline, online, or both – can do to distinguish their own offer in terms of service or brand, especially in a sector where product differentiation between one store and another is not necessarily great. Interestingly, one North East-based designer and manufacturer of bathroom products, Dovcor – which already sells its own-brand ranges via a network of independent retailers – thinks it has found a “revolutionary” way forward: a ‘quote and compare’ tool that it believes will both enhance the customer experience and promote the independent stockists with which it works.

Explaining his strategy, Dovcor’s owner, Will Ryles, told me that “with high streets in decline and major brands moving to large out-of-town developments, small independent bathroom retailers have been left fighting ever dwindling customer numbers. In an effort to stem the flow of customers out the door, small retailers have been forced to sacrifice quality for advertising budgets.

“The sad truth is that the real experts – those independents whose passion can make a bathroom truly inspirational – can easily be drowned out by bigger advertising budgets. With the likes of Next, Tesco and John Lewis moving into fitted bathrooms, we felt that the independent bathroom retailer needed a champion that would allow it to compete with those national advertising budgets while keeping high standards.

“In order to promote the best independent bathroom stores, we have created an online service that allows customers to get impartial advice, find local designers and fitters, obtain quotes and read reviews to find the best local stores for free.

“Furthermore, using the Dovcor brand’s national advertising, we’ll be able to attract and support potential customers from prospects through to real customers.

“The first step is a free visit to the customer to discuss their needs, even discussing the products that they already have in mind from other manufacturers. We then create the specification document [pictured below] and arrange for up to three local independent suppliers to design and quote for the bathroom – with no obligation to the customer, of course. All those suppliers will be from our ‘trusted list’, which it is free to be on following an initial meeting.

“Once the stores have sent their designs and quotes to the customer, we’ll happily support the customer in the decision-making process, analysing each quote and providing impartial advice.”

“At the end of the process, we will review and inspect every bathroom installed by one of our recommended suppliers, rating them after every job. We will take photos, get feedback from the customer in person, and make the scores available online for anyone to see!

“So, the concept is simple: to drive customers to the best local suppliers while making sure they get the best deal. Furthermore, by offering this free service nationally, local independents get the benefit of up to 1,000 tried and tested suppliers working together to give the big chains a run for their money.”

And what does Dovcor get out of it? “It’s true that we get a small cut, but the best way of describing this is that we get a small fee to cover our costs, with the hope being that we have also increased our chances of selling our products – which most of the trusted suppliers on our list already stock anyway.

“Another important thing to remember is that we take the hassle and poor leads on the chin, meaning that stores only experience a cost when they get a result – in other words, when they make money. However, even if we only get our costs covered, our hope is that both the store and the customer get positive experiences of our brand, helping our word-of-mouth recommendations and building our relationships with the stores.”

Overall, it does sound like a convincing proposition that has potential to deliver dividends for all those involved: the supplier, who can gain new sales through the association with Dovcor; the customer, who benefits from a simplified process and the reassurance of a national brand; and Dovcor, who gets to further develop both its brand and a distinctive market positioning.

If Dovcor’s approach is successful, perhaps it’s a model that has legs in other competitive home-related sectors – helping established indies compete with big-name retailers’ incursions into their territory, while protecting the individual qualities that customers like about independents in the first place.