As Shop Direct closes Woolworths online, is a high-street return now more likely than ever?

Update, 23 April 2017: The blog post below was published in June 2015, but it suddenly seems to have got topical again.

There are lots of ifs and buts about today’s Daily Star story about a possible Woolworths return, which is based on Tony Page, the company’s former Commercial and Marketing Director, wanting to buy the Woolworths brand from Shop Direct and relaunch Woolworths on the high street. As I noted in 2015, it’s plausible that Shop Direct might be willing to sell the brand, given that they are no longer using it, though no-one knows what their position is yet. Equally, we know nothing so far about whether Page really has the resources and backing to bring Woolworths back in some form.

Nothing would delight me more than seeing Woolworths return, but there are many potential obstacles before that can happen. Naturally, I’ll have more to say on the subject if the story progresses, but, for now, my comments from 2015 below are a pretty good summary of the challenges and opportunities that a revived Woolworths would face.

Shop Direct closing Woolworths.co.uk

Just a month ago, the UK press got unnecessarily excited when a silly April Fool story fuelled speculation that Woolworths might be returning to the high street. That was complete hokum – but now the reality of a Woolworths physical comeback may be closer than ever before.

The news that Shop Direct is to shut its Woolworths online store, following its acquisition of the brand back in 2009, is not especially a surprise. The company’s launch of Woolworths.co.uk was very effective – tapping into affection for the brand and enthusiasm for its return through clever use of social media – but since then there’s been a sense that Shop Direct hasn’t really known what to do with it.

Certainly, the promotion of Woolworths.co.uk has been quite low-key compared to that for Shop Direct’s big brands Very and Littlewoods (so no recreation of the famous Woolies Christmas ads, sadly), and beyond that initial PR blitz around the launch, there’s been limited effort to embrace the Woolworths brand heritage – which, you could argue, should be part of the point if you’ve just acquired a famous, century-old name.

Shop Direct is making the right decision now, though – Very continues to go from strength to strength as an online fashion and department store brand, and the reinvented Ladybird label (which Shop Direct acquired at the same time as Woolworths, and is keeping) is working well as a trusted name in childrenswear. There’s no point in hanging on to Woolworths if it is merely duplicating other parts of the business and has no USP of its own.

Could someone else revive Woolworths?

Naturally, all this has sparked speculation – not ruled out by Shop Direct – that the Woolworths brand could be sold off once the company has completed the migration of its Woolworths customers to Very. After all, Shop Direct reportedly saw off several other interested parties when it snapped up the Woolworths name in February 2009, and it would make sense to recoup some of the (undisclosed) amount that it originally paid.

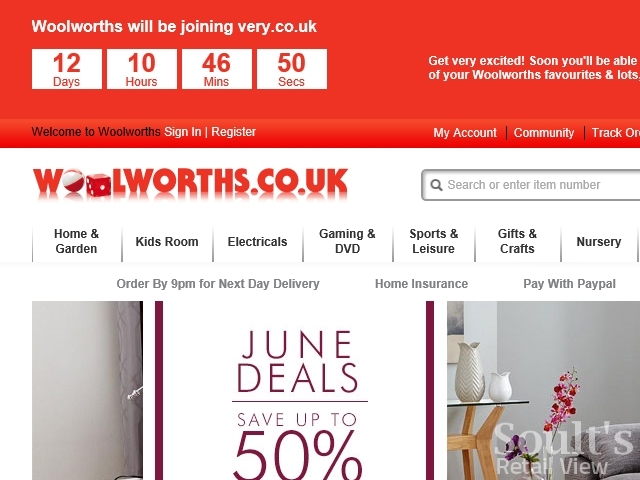

Indeed, you could possibly argue that the Woolworths brand is more valuable now than it was in the aftermath of its traumatic collapse, associated six years on with a feeling of warmth and nostalgia rather than one primarily of failure. Equally, Sport Direct owner Mike Ashley’s entry into the value variety store sector with his new MegaValue.com fascia (linked to speculation that he might be interested in a Woolworths relaunch), confirms – if we didn’t already know it thanks to Poundland, B&M, Home Bargains, and the like – that there are plenty of profits to be made selling useful stuff under one roof on the high street.

As an aside, it seems quite appropriate that the first MegaValue.com has opened in Kidderminster – next to one of the handful of Woolworths sites yet to be occupied since 2009, and in premises that housed Shop Direct-owned Littlewoods prior to the chain’s withdrawal from physical stores in 2006. (It’s extraordinary how you can nearly always make an obscure but fascinating connection between one retail company and another – regular readers will know it’s something I do a lot of!)

The challenge of bringing Woolworths back now

The challenge, of course, is how on earth do you recreate Woolworths for 2015 in a way that is respectful of what people loved about the business in the past, but doesn’t simply recreate the problems that precipitated its collapse in the first place?

For example, sticking the Woolworths name over a Sports Direct-style store selling lots of random bargains would be likely to rankle, but nor would anyone sane relaunch a shop where CDs and DVDs are a significant chunk of the product offer.

It’s probably worth repeating here my suggestions from April about what a reinvented Woolworths could look like:

…players like Poundland and B&M – and the supermarkets that helped clobber Woolworths previously – have mopped up much of the trade in things like children’s party gear, Easter eggs and Christmas decorations.

Children’s clothing is maybe more lucrative – with groups like Let Clothes Be Clothes campaigning for a better choice on the high street – though the Ladybird brand is also now part of the Shop Direct empire.

To be honest, Woolworths’ main USP is that fantastic and unique brand heritage, and the warm glow that it still conjures up in many shoppers, who – you hope – would be more alert to the possibility of letting it fail a second time.

So, if you were bringing Woolies back to the high street, maybe there would be merit in going down a deliberately nostalgic and retro route – with cafés, pick and mix, broken biscuits, ice cream, and a treasure trove of useful stuff – perhaps even bringing back the single price point that Woolworths pioneered all those years ago with its 3d and 6d stores, and that Poundland has reinvented for the modern shopper.

Given the entry of European variety retailers like Hema and Tiger into the UK market, perhaps even the German Woolworth (no ‘S’) could be convinced to set up in Britain? It too collapsed (in 2009), but has successfully rebuilt its business under new ownership.

Understandably, opening UK stores hasn’t been possible to date – as Germany’s Woolworth doesn’t hold the Woolworth(s) trademark in this country – but if it were to acquire the UK brand, then that could be an option.

If nothing else, the German Woolworth certainly understands the brand heritage – both the UK and German operations grew out of F.W. Woolworth Co.’s launch in the USA in 1878-79, and each remained part of the American parent group for over a century until the UK business was spun off in 1982.

In a nod to this heritage, the German Woolworth includes the words ‘seit 1879’ (‘since 1879’) as part of its logo, though the first Woolworth store in Germany didn’t actually open until 1927, some 18 years after the chain’s arrival in the UK (in Liverpool’s Church Street).

Sadly, despite humorous suggestions on Twitter that I might look to assemble my own bid, my funds hardly stretch to snapping up the Woolworths brand, never mind then doing anything with it.

Looks as though the Woolworths name could be for sale. Looking forward to @Soult assembling his bid…! http://t.co/OWPc45H7Sh

— Philip Downer (@frontofstore) June 1, 2015

Still, if any interested parties wished to bring on board my expertise and knowledge – described by one Twitter friend as “a priceless Woolies ‘database of everything’ in your head” – then my consultancy services are always available for a suitable fee!

@soult @frontofstore Oh, I'm sure. Just the Woolies "database of everything" in your head would be priceless…

— Mark Webb (@MarkWebb_DC) June 1, 2015

My retail consultancy business, CannyInsights.com, provides bespoke place- and sector-specific market insight, including detailed coverage of the North East and nationwide. It also works with retailers to improve their stores, customer communications and market knowledge. For more information, visit www.cannyinsights.com, drop me an email, or give me a call on (0191) 461 0361.